colorado employer payroll tax calculator

Colorado has no state-level. The maximum an employee will pay in 2022 is 911400.

Employer Payroll Tax Calculator Free Online Tool By Incfile

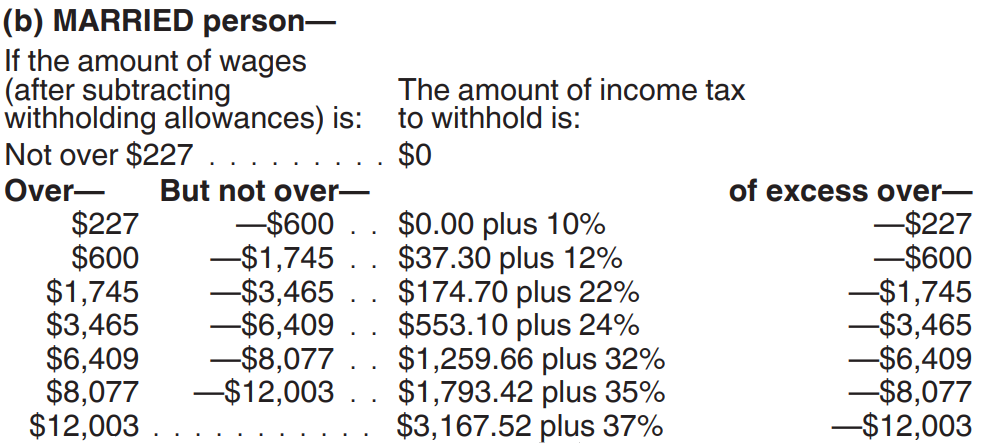

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding.

. Colorado FLI employer rate. Could be decreased due to state unemployment. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Medicare 145 of an employees annual salary 1. The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums.

Employers are required to file returns and remit. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Simply enter the calendar year your premium.

Employers may also choose to pay the full amount if they would. Along with a few other. The standard FUTA tax rate is 6 so your max.

DR 0004 Employer Resources. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. 50 of 09 for 2022.

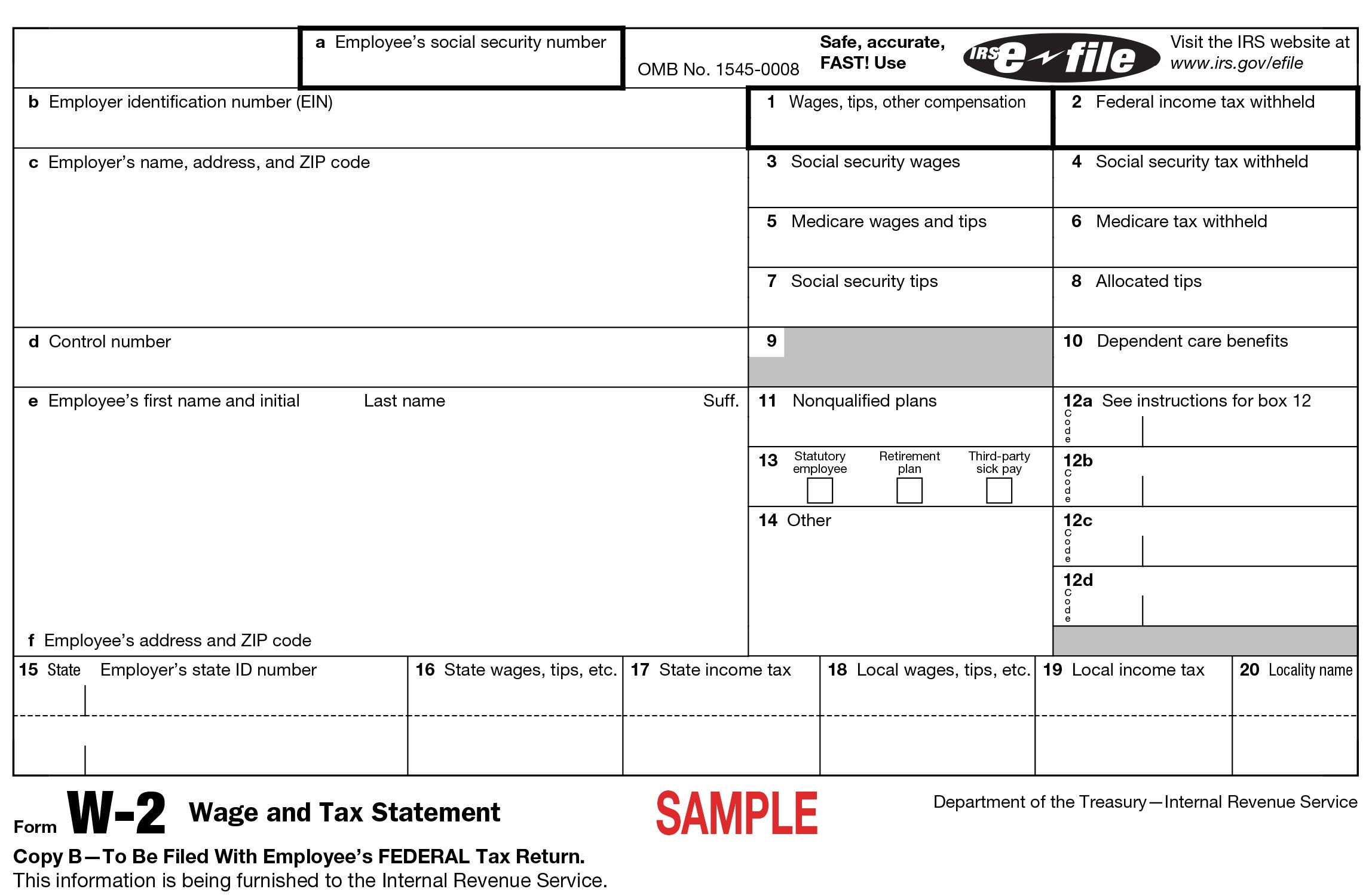

Simply enter their federal and state W-4 information as. Employer Forms CR 0100 - Sales Tax and Withholding Account Application DR 1093 - Annual Transmittal of State W-2 Forms DR 1094 - Colorado W-2 Wage W. The state income tax rate in Colorado is a flat rate of 455.

California Payroll Tax Withholding Tables 2018 Awesome. Colorado Hourly Paycheck Calculator. This colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Colorado Salary Paycheck Calculator. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. Use the Colorado paycheck calculators to see the taxes on your paycheck.

SmartAssets Colorado paycheck calculator shows your hourly and salary income after federal state and local taxes. Just enter the wages tax withholdings and other information required. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Enter your info to see your take home pay. A state standard deduction exists and is available for those that qualify for a federal standard deduction. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado.

No Withholding Tax Collected. Determine withholdings and deductions for your employees in any state with incfiles simple payroll tax calculator. California Payroll Tax Withholding Tables 2018 Awesome.

Colorado Employer Payroll Tax Calculator. The premiums are set to 09 of the employees wage with 045 paid by the employer and 045 paid by the employee. Youll pay 575 monthly if.

Account Set-Up Changes. Colorado Paycheck Calculator Calculate your take home pay after federal Colorado taxes Updated for 2022 tax year on Aug 02 2022. Determine withholdings and deductions for your employees in any state with incfiles simple payroll tax calculator.

/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

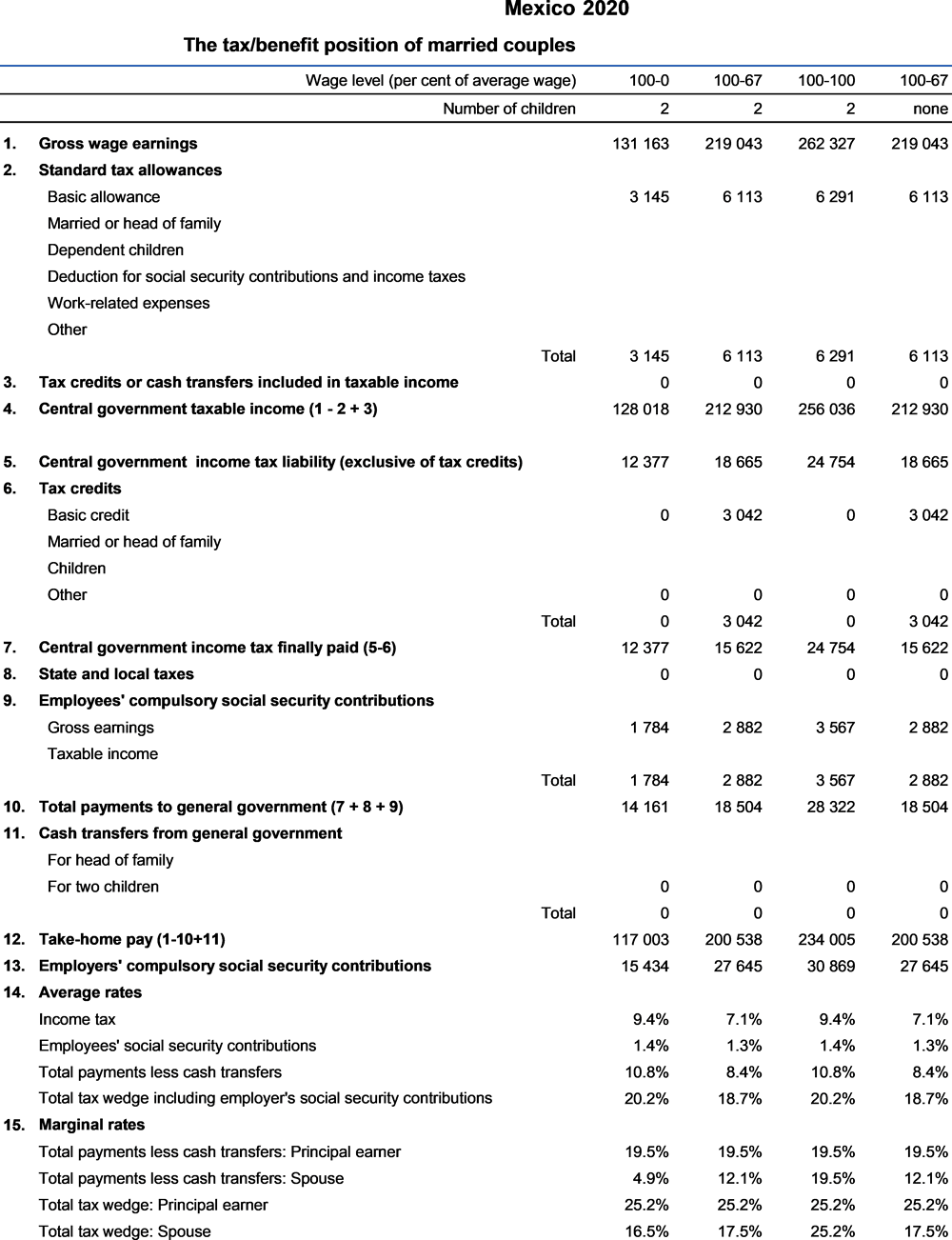

Mexico Taxing Wages 2021 Oecd Ilibrary

Colorado Payroll Tax Registration The Ultimate Guide Faqs

Colorado Paycheck Calculator Smartasset

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

The Average U S Worker Pays Over 16 000 In Income And Payroll Taxes Tax Foundation

How To Calculate Payroll Taxes Wrapbook

2018 Upcoming Legislative Changes Affecting Payroll Tax Calculation Checkmatehcm

:max_bytes(150000):strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-b2584d2f80b043d0814fca81c1b1fecf.jpg)

How To Budget For Taxes As A Freelancer

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Read Your W 2 University Of Colorado

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Payroll Taxes

Payroll Tax What It Is How To Calculate It Bench Accounting

Colorado Paycheck Calculator Tax Year 2022

Colorado Paycheck Calculator Smartasset